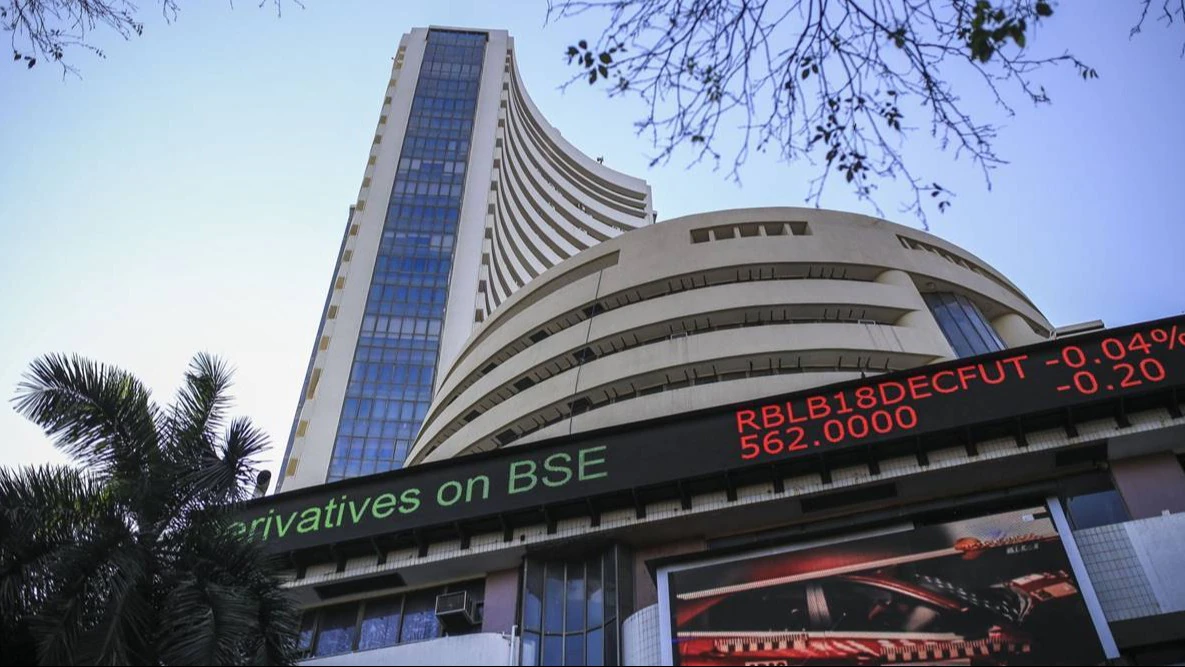

On May 23, 2025, the share price of BSE Ltd. (Bombay Stock Exchange) experienced a significant drop of over 65%, falling from ₹6,996 to ₹2,335 during intraday trading. This sharp decline raised concerns among investors. However, it’s essential to understand that this drop is primarily due to the stock trading ex-bonus following a 2:1 bonus issue, rather than a reflection of the company’s fundamentals.

📉 What Caused the Sharp Decline in BSE Share Price?

The apparent crash in BSE’s share price is attributed to the stock turning ex-bonus on May 23, 2025. In a 2:1 bonus issue, shareholders receive two additional shares for every one share held. This increases the total number of shares outstanding, leading to a proportionate adjustment in the share price to maintain the company’s market capitalization. Therefore, the drop in share price is a technical adjustment and does not indicate a loss in shareholder value.

📊 Understanding Bonus Issues and Ex-Bonus Trading

A bonus issue involves a company issuing additional shares to existing shareholders at no extra cost, based on the number of shares already owned. The purpose is to increase the liquidity of the stock and make it more affordable for investors. When a stock goes ex-bonus, it means that new buyers of the stock are not entitled to the recently declared bonus shares. Consequently, the share price adjusts downward to reflect the increased number of shares in circulation.

🧮 Impact on Shareholders

For existing shareholders, the ex-bonus adjustment does not result in a financial loss. Although the share price decreases, the number of shares held increases proportionally, keeping the total investment value unchanged. For example, if an investor held 100 shares at ₹6,996 each before the bonus issue, their total investment was ₹699,600. Post the 2:1 bonus issue, they would hold 300 shares at approximately ₹2,332 each, maintaining the total investment value.

📈 BSE’s Financial Performance

Despite the recent share price adjustment, BSE Ltd. has demonstrated strong financial performance. The company’s earnings per share (EPS) for the trailing twelve months (TTM) is ₹97.94, with a price-to-earnings (P/E) ratio of 24.86, indicating a healthy valuation. Additionally, BSE has a market capitalization of ₹32,957 crore and a dividend yield of 0.94%, reflecting its robust financial position.

🔍 Analyst Outlook

Analysts view the ex-bonus price adjustment as a technical correction and maintain a positive outlook on BSE’s stock. The company’s strong fundamentals, consistent dividend payouts, and strategic initiatives position it well for future growth. Investors are advised to consider the underlying financial health of the company rather than short-term price movements resulting from corporate actions like bonus issues.

📝 Final Thoughts

The significant drop in BSE’s share price on May 23, 2025, is a result of the stock trading ex-bonus following a 2:1 bonus issue. This technical adjustment does not reflect any deterioration in the company’s financial health